Introduction:

Manage your finances like a pro with QuickBooks Self-Employed! Whether you're a freelancer, independent contractor, or self-employed, this app is your ultimate financial companion. With powerful features like automatic mileage tracking, expense organization, and tax deductions estimation, QuickBooks Self-Employed helps you maximize your income and stay ahead of tax season. Say goodbye to financial chaos and hello to financial success!

Key Features:

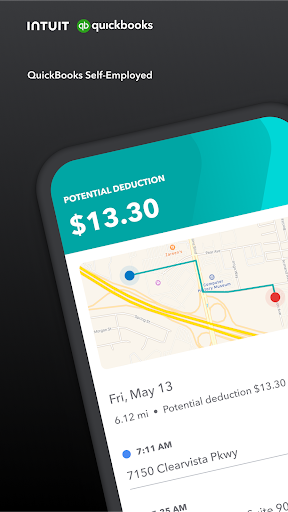

- Automatic Mileage Tracking: Say goodbye to manual mileage logs! QuickBooks Self-Employed uses your phone's GPS to automatically track your miles, ensuring accurate mileage deductions without draining your battery.

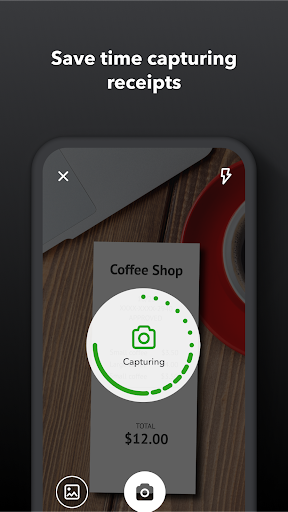

- Receipt Scanner: No more lost receipts or hours spent sorting through paperwork. The receipt scanner extracts transaction details and matches them to expenses, keeping you organized for tax time. Store digital copies in the cloud for easy access anytime, anywhere.

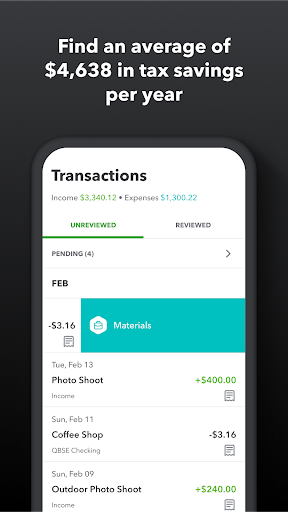

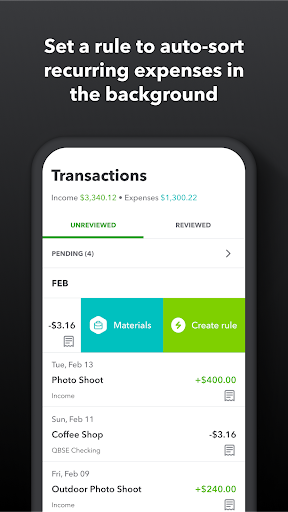

- Expense Tracker: Easily manage your business finances by importing expenses directly from your bank account. Categorize expenses to stay on top of your budget and never miss out on valuable tax deductions.

- Stay Prepared for Tax Time: QuickBooks Self-Employed takes care of your bookkeeping, providing a clear overview of your income and expenses. With instant tax filing and export options, you'll breeze through tax season stress-free.

- Seamless Integration with TurboTax: Upgrade to the Tax bundle and effortlessly export your financial data to TurboTax Self-Employed, simplifying your tax filing process and ensuring accurate returns.

Developer:

Developed by Intuit Inc, a trusted leader in financial software, QuickBooks Self-Employed is backed by a reputable company known for creating innovative products. Intuit Inc has a proven track record, offering high-quality solutions like TurboTax and QuickBooks. Count on Intuit's expertise and experience to support your financial success.

Pros and Cons:

Transparency is our priority, so let's dive into the pros and cons of QuickBooks Self-Employed:

- Pros:

- Effortless mileage tracking with GPS automation

- Time and paper savings with the receipt scanner

- Streamlined expense management for maximum tax deductions

- Seamless integration with TurboTax for hassle-free tax filing

- Backed by Intuit's reputable track record

- Cons:

- Availability of certain features may vary by location

- Subscription-based pricing

History or Fascinating Insights:

Behind QuickBooks Self-Employed lies the dedication and expertise of Intuit's team. With a deep understanding of the challenges faced by self-employed individuals, the app has evolved to meet their unique financial needs. Countless hours of research, development, and user feedback have shaped QuickBooks Self-Employed into the ultimate financial tool, ensuring your success as you navigate the world of self-employment.

Target Audience:

QuickBooks Self-Employed is designed for self-employed individuals, freelancers, and small business owners. It caters to anyone looking to take control of their finances, maximize tax deductions, and simplify their bookkeeping. Whether you're just starting your self-employed journey or are a seasoned professional, QuickBooks Self-Employed is the perfect companion for your financial success.

Technical Details:

- Version: Varies with device

- Size: Varies with device

- Compatibility: Varies with device

- Age Rating: Everyone

Crucial Note: QuickBooks Self-Employed is not your typical financial app. It's a game-changer that will transform the way you manage your finances. Say goodbye to stress and hello to financial freedom with QuickBooks Self-Employed!