Introducing Walmart MoneyCard: Manage and Access Your Money with Ease

Discover a seamless and convenient way to handle your finances with Walmart MoneyCard. Our app revolutionizes the way you manage and access your money, providing you with unrivaled features and benefits. Say goodbye to the hassle of traditional banking and experience the future of personal finance.

Key Features

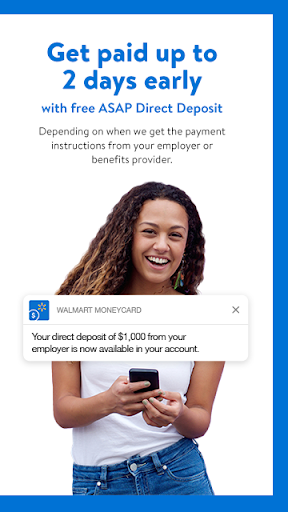

- Early Paycheck Access: Get your pay up to 2 days early with direct deposit, giving you greater financial freedom.

- Cash Back Rewards: Earn generous cash back rewards on your purchases, with 3% on Walmart.com, 2% at Walmart fuel stations, and 1% at Walmart stores. Enjoy up to $75 in cash back rewards each year.

- Family Sharing: Share the love and order accounts for up to 4 additional approved family members aged 13+ at no additional cost.

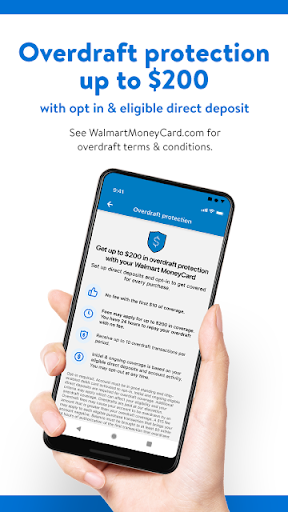

- Overdraft Protection: Opt-in and receive up to $200 in overdraft protection with eligible direct deposit. Say goodbye to unexpected fees and enjoy peace of mind.

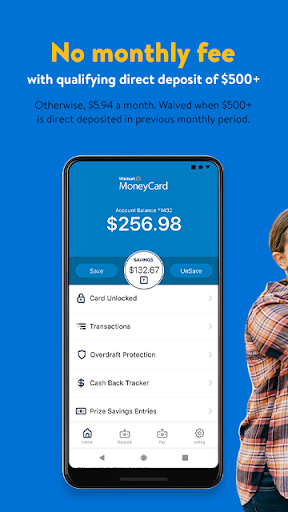

- Zero Monthly Fees: Qualifying direct deposit of $500+ exempts you from monthly fees. Otherwise, enjoy our low monthly fee of $5.94.

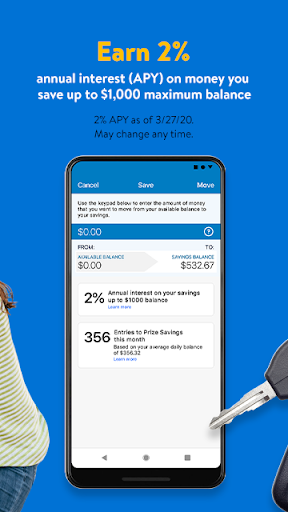

- High-Interest Savings: Earn an enticing 2% interest rate on your savings, helping you grow your wealth effortlessly.

- Card Lock Protection: Misplaced your card? Simply press LOCK in the app to prevent unauthorized purchases. Press UNLOCK to instantly restore functionality.

Developed by Green Dot: Trust and Innovation

Walmart MoneyCard is the brainchild of Green Dot, a distinguished company renowned for its cutting-edge financial solutions. With a proven track record of excellence, Green Dot has created a range of innovative products trusted by millions worldwide. Experience the power of their expertise in personal finance as you embark on your financial journey.

Pros and Cons

- Pros:

- Early paycheck access for greater financial flexibility

- Generous cash back rewards at Walmart.com, fuel stations, and stores

- Free family account sharing

- Overdraft protection for peace of mind

- No monthly fees with qualifying direct deposit

- High-interest savings to help grow your wealth

- Card lock protection for added security

- Cons:

- Monthly fees may apply without qualifying direct deposit

- Card lock protection does not waive monthly fees

- Some features may only be available on personalized cards

The Fascinating Story Behind Walmart MoneyCard

Did you know that Walmart MoneyCard is the result of years of dedication and innovation? Our app was meticulously crafted by a team of financial experts and technology enthusiasts, combining their expertise to create a revolutionary financial tool that sets a new standard. Join us on this remarkable journey and be a part of the future of personal finance.

Target Audience: Tailored for Everyone

Walmart MoneyCard is designed to meet the needs of individuals from all walks of life. Whether you're a student learning to manage your finances, a hardworking professional looking for greater financial control, or a retiree seeking simplicity, our app caters to your unique requirements. Age, interests, and skill levels are no barriers – everyone can benefit from this powerful financial solution.

Technical Details

- Version: 1.50.1

- Size: 38.9 MB

- Compatibility: Android 5.0+ (Lollipop, API 21) and above

- Age Rating: Everyone

Note: Walmart MoneyCard offers a fresh perspective on managing and accessing your money. With unparalleled features, the app allows you to take control of your finances like never before. Experience the future of personal finance – download Walmart MoneyCard today!